Who Can Apply for the Card?

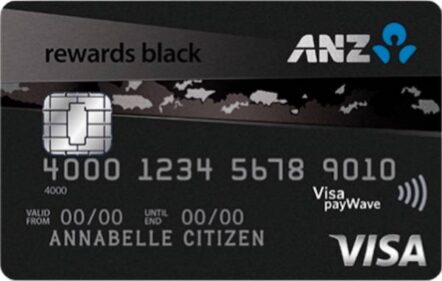

The ANZ Rewards Black Credit Card is best suited for individuals with a strong financial background who can manage a minimum credit limit of $15,000. Applicants must be at least 18 years old, have a stable income, and meet ANZ’s lending criteria.

If you frequently use a credit card for high-value purchases and can pay off most of your balance each month, this card could be a great fit. However, those who only make minimum repayments should consider other options with lower interest rates. Always assess your financial standing before applying.

Required Documentation

To apply, you’ll need to provide a valid form of identification, such as a passport or driver’s license. Proof of income, like recent payslips or tax returns, will be required to confirm eligibility. If self-employed, you may need additional financial documents.

ANZ may also request details of your expenses and liabilities, including existing loans or credit cards. Ensuring your documents are up to date will streamline the approval process.

A Tip for You!

Maximize your rewards by using your ANZ Rewards Black Credit Card for everyday purchases and large expenses. To avoid interest charges, always aim to pay your balance in full within the statement period.

Booking flights and travel expenses through ANZ partners can also help you unlock even greater value. Additionally, make sure to redeem your points before they expire to get the most out of your rewards program. Smart spending can help you turn everyday transactions into valuable perks.

After Learning How to Apply for the ANZ Rewards Black Card, ready to take the next step?

After Learning How to Apply for the ANZ Rewards Black Card, click on the button below to start your application online. Ensure you have the required documents ready for a seamless process. If you have any questions, ANZ’s customer support team is available to assist you. Take the next step in maximizing your rewards today!