✅Personalised Interest Rates: Enjoy better rates based on your credit score.

✅Flexible Loan Terms: Choose between fixed or variable rates with terms from 1 to 7 years.

✅Same-Day Funds: Get your money on the same day for in-branch applications approved by midday.

✅No Collateral Required: Borrow up to $50,000 without needing to secure it with an asset.

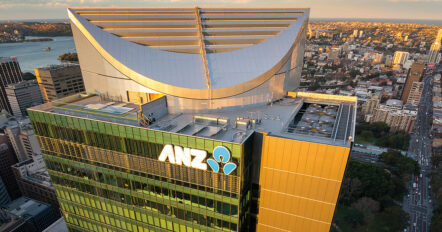

Why Does the Utua Team Recommend the ANZ Personal Loan?

The Utua Team recommends the ANZ Personal Loan for its flexibility and customer-friendly features. With the option to choose between fixed and variable rates, borrowers can select a loan term that suits their financial situation. The same-day funds availability for in-branch applications is a significant advantage for those in need of quick financial assistance. ANZ’s personalised interest rates ensure that you get a rate tailored to your credit profile, potentially saving you money. Additionally, the loan’s unsecured nature allows you to borrow up to $50,000 without the need for collateral, making it accessible to a wider range of customers.

Writer’s Opinion

Using an ANZ Personal Loan simulation demonstrates its advantages. For example, borrowing $15,000 at an interest rate of 10.99% over four years would result in monthly payments of approximately $390. The flexibility to choose between fixed and variable rates offers stability or adaptability based on your preference. The same-day fund disbursement for in-branch applications is ideal for urgent needs. ANZ’s approach to personalised interest rates and flexible loan terms makes it a reliable choice for various financial requirements.

I Want to Learn More About the ANZ Personal Loan

Interested in finding out more about the ANZ Personal Loan? Click on the button below to learn more about how this loan can help you achieve your financial goals.